- The Good News Newsletter

- Posts

- How to Actually Find a Co-Founder (Hint: It’s Not on a Job Board)

How to Actually Find a Co-Founder (Hint: It’s Not on a Job Board)

Insights from our April 4th 'Good News' Sessions

Welcome to the 4th edition of The Good News Newsletter—proudly serving over 4,119 founders! Here, we break down the latest insights from our weekly Family Office Hours sessions and equip you with tools to help you secure the capital and spread ‘The Good News’.

Missed the live session? Listen to the recording here.

Want to join the next session? Check out the full list of past and upcoming VCs here.

Overview:

This week, we hosted two insightful sessions with our fantastic guest investors and introduced a new third session:

Session #1: Arif Damji, Principal at Conductive Ventures

Conductive Ventures backs unconventional, often-overlooked founders, building capital efficient companies in diverse geographies; writing $3M - $10M checks.

Session #2: Mfoniso Ekong, Managing Director of the Northwestern Mutual Black Founder Accelerator powered by gener8tor.

The Northwestern Mutual Black Founder Accelerator invests $100K in up to ten high-growth startups per year founded by entrepreneurs who have been historically underserved in accessing capital.

Session #3: Founder Debrief & Open Discussion

A new open-format session where founders reflect on lessons from the investor conversations, share wins and testimonies, and ask for support.

4/24 Event (Tulsa): Accelerate North Tulsa Pitch Night – Cohort 5

Roselly and I will be presenting our first project under the banner of The Frater Family Foundation at Central Library, Downtown Tulsa, Oklahoma on Thursday, April 24 at 6pm as participants in the Accelerate North Tulsa Accelerator. Join us!

RSVP: https://lu.ma/aozxy5ox

Office Hours Recap:

Session #1 - Arif Damji, Principal at Conductive Ventures

Stage: Series A

Industry: B2B SaaS, Tech-Enabled Services, and broader scalable technology sectors

Check Size: $3M - $10M

How to Apply: Reach out via referral or through a direct connection to a team member who can become your internal advocate during diligence.

Key Takeaways from Session:

Revenue and Efficiency Benchmarks Matter: For B2B SaaS, Conductive looks for at least $2M in ARR with margins above 75%. For tech-enabled services, $5M+ in revenue and 35%+ margins are a baseline. Efficient capital usage is critical—founders who’ve raised less than 2–3x their ARR stand out.

Clarity in Diligence Hypotheses: Conductive operates with a hypothesis-driven diligence process. Investors write down key beliefs that must be proven true (or false) to justify the deal. Founders benefit by being transparent, collaborative, and helping investors test those hypotheses during diligence.

Founders Drive the Narrative: Arif emphasized that VCs don’t have all the answers—founders should own their narrative, show traction clearly, and demonstrate why they are the right team to solve the problem. Strong teams are operators first, not just fundraisers, and they earn trust by showing focus, domain expertise, and authenticity.

Session #2 - Mfoniso Ekong, Managing Director of the Northwestern Mutual Black Founder Accelerator powered by gener8tor.

Stage: Pre-Seed & Seed

Industry: Fintech, Insurtech, Data Analytics, and Digital Health (focused on longevity and caregiving)

Check Size: $100K

How to Apply: Founders can apply through the gener8tor accelerator program website. Proactive outreach and attending office hours are helpful.

Key Takeaways from Session:

Strategic Corporate Partnership: The program’s backing by Northwestern Mutual creates a unique opportunity for founders to work directly with executives and potentially secure pilots, strategic support, and follow-on investment from NM’s corporate venture arm.

Vertical-Specific Investment Focus: The accelerator prioritizes companies building in wealth tech, advisor tools, life/disability insurance tech, longevity and caregiving, and cybersecurity—areas directly aligned with Northwestern Mutual’s business needs.

Personalized and Relationship-Driven Selection Process: Mfoniso emphasized the importance of early relationship building and personalized engagement. Founders who connect with the team ahead of time, attend events, and demonstrate coachability stand out. The team values traction, clarity of vision, and strong founder-market fit over polished metrics.

[NEW] Session #3 - Founder Debrief & Open Discussion

Session #3 this week felt like a divine appointment! Founders dropped wisdom, scripture, and startup strategy all in the same breath. There were real moments—prayers for healing, testimonies of faith through burnout, and bold reminders that God doesn’t call the qualified, He qualifies the called. One founder shared how AI tools are helping her go from solo to scalable, while another spoke life into the group with a word on enduring through spiritual warfare. It wasn’t just a debrief—it was church for builders. A true reminder that we’re not just building companies; we’re walking in purpose.

Funding Resources:

💰 Resources of the Week:

The Camelback Fellowship is a 16-week program that supports the development of both founder and venture with a $40K investment and additional resources.

Deadline: 4/7/2025UpGreyed Her is a financial inclusion initiative by Grey designed to empower female entrepreneurs by providing them with up to $4K in capital to expand their businesses.

Deadline: 4/8/2025Famous Amos Ingredients For Success Entrepreneurs Initiative

IFS creates pathways for early-stage Black business owners to thrive by providing $150,000 in capital awards, mentorship, networking, and educational resources.

Deadline: 4/23/2025The MSP Equity Accelerator sponsored by Allianz invests $100K each into five high-growth startups founded by undervalued entrepreneurs.

Deadline: 4/25/2025

2025 Urban Future Prize Competition

Urban Future Lab identifies and supports top climatetech startups; providing two $50K cash prizes.

Deadline: 4/28/2025The Enthuse Foundation offers a series of financial grants, up to $10K, to assist entrepreneurs with critical business needs.

Deadline: 4/28/2025The 2025 Black Ambition Prize Competition

The Black Ambition Prize competition provides a platform for underrepresented founders across the nation to access $15K - $1M in growth capital, coaching, and a curated community of innovators and mentors.Deadline: 5/2/2025

MassCEC Equity Workforce Planning & Capacity Grants

Equity Workforce Planning and Capacity Grants provide up to $150,000 to start or expand a clean energy equity workforce program.Deadline: 5/19/2025

Pathway to Opportunity is a competition designed to connect small businesses with corporations seeking to expand their supply chain with innovative products and services; providing a $5K cash prize to three winners.

Deadline: 6/9/2025Santander x Cultivate Small Business

Santander’s Cultivate Small Business helps early-stage entrepreneurs build and sustain businesses in the food industry providing a 12 week food-focused curriculum, mentorship, and up to $20K in capital grants.Deadline: 7/8/2025

🎧 Podcast of the Week:

Summary: Eron Galperin shares how he bootstrapped a niche SaaS business from a Brazilian jiu-jitsu side project to a multi-million-dollar exit—and how he now lives a FIRE (Financial Independence, Retire Early)-optimized, low-stress life in Japan. He talks about slow growth, resisting VC timelines, the psychology of financial independence, and the quiet joy of intentional living after a win.

Why I recommend it: Eron’s journey is a compelling counter-narrative to the high-burn, high-growth startup playbook. He didn’t chase VC funding or force artificial growth. Instead, he built a profitable business slowly, with intention, while maintaining his autonomy. His story is a reminder that the best exit paths aren’t always the most obvious or loudest ones. What makes this episode especially powerful is how he breaks down the emotional transition post-exit—how financial independence shifted his mindset, habits, and relationship with time. For founders grinding toward their first exit (or even wondering what comes after), this episode is equal parts tactical and philosophical. It might just change how you define success. You can listen here.

Alternative Funding Sources:

Access up to $2M in non-dilutive debt financing. Request information here.

Raise up to $5M in equity capital through a Community Round. Request information here.

Need additional support in your fundraising journey? I will be working 1 on 1 with select founders to help. Founders interested in 1 on 1 support from me can learn more and consider submitting their company here.

Tweet of the Week:

Founder Question:

“Hi Darrel, do you have any advice for finding a co-founder? I’ve been searching in my network and on sites like YC’s Co-Founder Lab, but it’s been hard finding someone truly aligned with my vision.”My response:

Finding a co-founder is hard, don't expect it to— Darrel Frater ✝️ (@DarrelFrater)

1:00 PM • Apr 1, 2025

That’s all for this week’s edition of The Good News Newsletter. We hope you found these insights valuable as you continue your journey to securing funding.

What’s next?

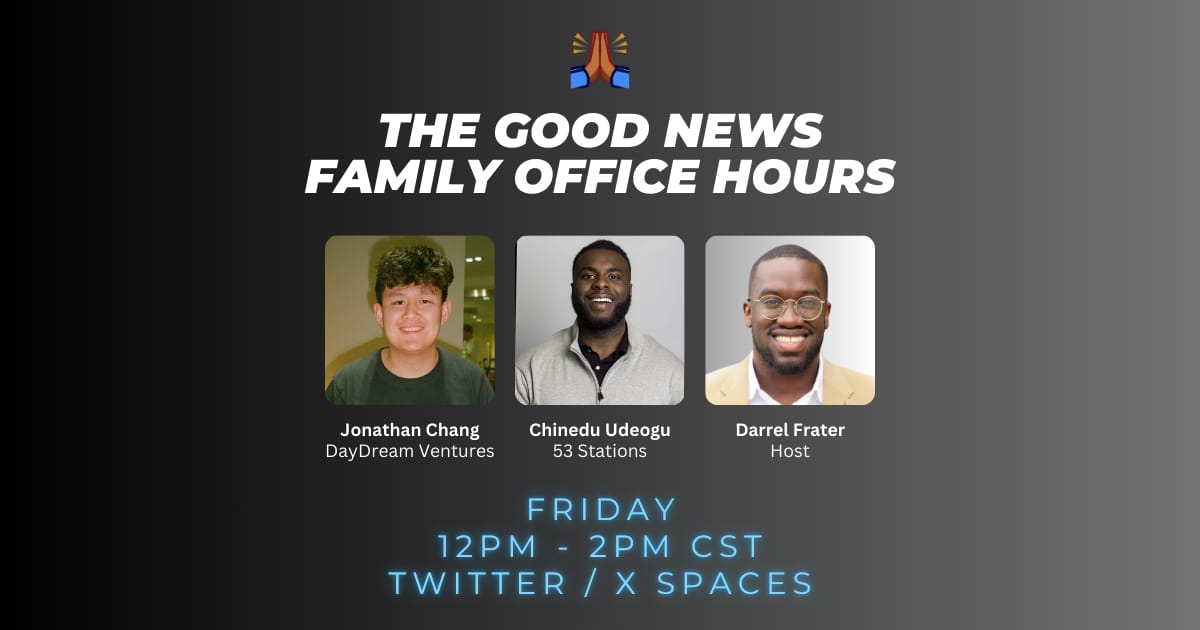

Join us next Friday for two more amazing guests joining us for Office Hours.

For session #1 we have Jonathan Chang, GP at DayDream Ventures.

DayDream Ventures is a venture fund investing in founders building with community-led growth in mind in.

For session #2 we have Chinedu Udeogu, Investor at 53 Stations.

53 Stations is a Chicago-based venture capital firm, supported by The Pritzker Organization, that backs early-stage tech companies with flexible capital and strategic support.

If interested in joining and/or pitching, please register here.

You can see the full list of past and future VCs on this Calendar.

Be on the look out for our newsletter next week where we’ll bring you more actionable advice, resources, and success stories.

Let’s All, spread ‘The Good News’

Best,

Darrel Frater

Co-Founder

The Frater Family Foundation

Linkedin | Twitter/X | 609-804-5999

P.S. - If you enjoyed this newsletter, forward it to a founder you know who could benefit from these insights!

P.S.S. - Got ideas or suggestions for The Good News? Shoot me an email at [email protected] for us to discuss!

About TFFF: The Frater Family Foundation is the philanthropic arm of the family office of Darrel and Roselly Frater, dedicated to promoting human prosperity through giving. To learn more, reach out to Darrel Frater directly.

Reply